Looking Ahead

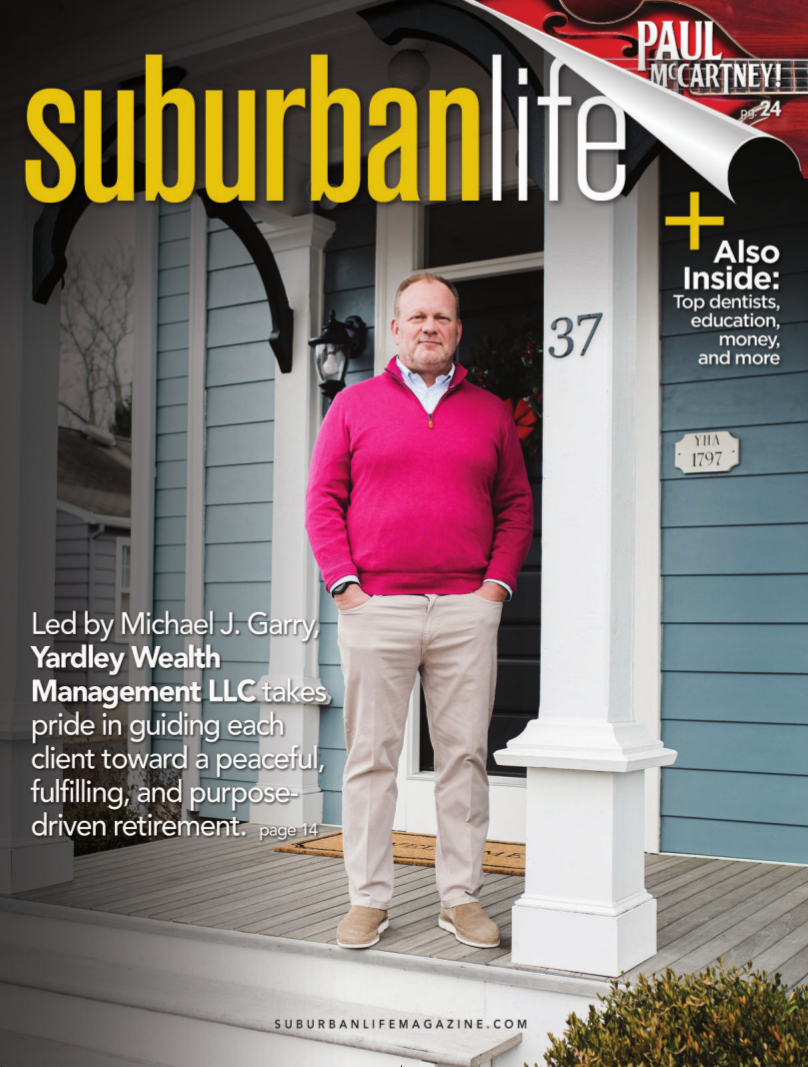

Led by Michael J. Garry, Yardley Wealth Management LLC takes pride in guiding each client toward a peaceful, fulfilling, and purpose-driven retirement.

In most respects, America is a nation of planners. We plan for the purchase of a new car or a second home. We map out kitchen renovations and other home improvements. We plot out dinners, weekend itineraries, and upcoming vacations. Unfortunately, too many people fail to plan adequately for one of the most important aspects of American life: our retirement.

Michael J. Garry, CFP®, AIF®, knows all about the importance of planning—and the risks of going without. As the founder and CEO of Yardley Wealth Management LLC, Garry has spent most of his adult life helping individuals and families plan for the future. His firm, which recently opened a new office on Main Street in Yardley, celebrated its 15-year anniversary in February.

“Most people have never worked with a financial advisor or planner and don’t know what to expect, so they just don’t do it,” he says. “Some people might be afraid of what it might cost or they’re afraid of getting taken advantage of. Those are legitimate fears, but people shouldn’t let those fears keep them from exploring something that can have a profound effect on their lives.”

He proposes a solution for people who do not know where to begin: Seek out a fiduciary, meaning an individual who has a legal and ethical responsibility to put a client’s interest ahead of their own. He describes his fee-only firm as “completely independent,” meaning it has no ties to any particular financial products or services. Put another way, he would not earn commissions for recommending certain products that would go against a client’s best interests.

“So many people go about planning every other aspect of their lives, but they don’t have any plan about their retirement,” he adds. “A financial planner can sit down with a client and show them, ‘OK, you’re in your 40s now. If you save 10 percent of your pay instead of 8 percent, or 8 percent instead of 6 percent, the difference can be gigantic by the time you retire.’ Making subtle moves earlier is much better than waking up one day at 58 and saying, ‘What do I do now?’”

Garry has plenty of support, starting with team members Karen Lynch and Sandra Austin. Lynch, the firm’s client services and operations manager, serves as a point of contact and makes sure things run smoothly, while Austin, who is an operations associate, works behind the scenes to help the firm achieve its goals. In addition, Garry utilizes sophisticated software for financial planning and portfolio management to help clients prepare for the future. His client list includes individuals who are either close to retirement or already in retirement, from a wide range of backgrounds—executives and business owners, for example, as well as teachers, nurses, and other professionals.

“These are people who are aware of what’s going on in the world and have done well in their professional lives,” he says. “They’re also smart enough to realize that they don’t know everything. They need someone to talk to and understand their situation so they can figure out what to do next.”

Thinking It Through

Garry started his career as a full-time attorney. He still practices law on a part-time basis, mostly by offering estate planning to advisory clients. His true passion, however, lies in helping clients identify their goals for the future and then creating a road map to help them get to the destination they have in mind. Although he enjoys working with ones and zeros, what he likes most about the work is the opportunity to learn about people and what’s important to them, and then coaching them through their options going forward.

In Garry’s mind, planning applies not only to the financial aspects of life, but also to issues tied to identity and purpose. In other words, he helps clients answer an important question most people do not spend enough time mulling over: “What will I do with my time in retirement?” In this regard, his job involves its share of psychology, in that he has to understand how his clients think—their hopes and dreams, as well as their fears and worries.

“The financial part is easy,” he says. “The other stuff is more difficult. Some people spend their lives working in challenging, stressful jobs, and when they’re done they don’t know what to do next. That can be an awful realization. Planning for that aspect of your life is part of the process, too. It could be a range of things: consulting, volunteering, watching the grandkids. My dad plays a lot of pickleball and golf. My point is this: You have to think about it. Some people often end up back working at their jobs because they haven’t given it enough thought.”

With so many options, Garry suggests investors need to do their homework when vetting financial advisors. He suggests “interviewing” a number of advisors to identify which one would best help them achieve financial security and peace of mind. In fact, he wrote a book about this topic, Independent Financial Planning: Your Ultimate Guide to Finding and Choosing the Right Financial Planner, to help readers navigate a process that can be confusing, if not overwhelming.

A common misunderstanding is that financial planning is reserved only for the wealthy. Garry certainly has his share of clients with millions of dollars to invest, but he believes everyone could benefit from planning for the future.

“It doesn’t have to be a 100-page plan, but your plan should take into account how you want to spend your retirement years,” he says. “To me, the risk [of not planning] is too great. Otherwise, you might not be able to do what you’d like to do, and you might have to work much longer than you want. Some people might get to a place where they can’t afford to not work. With a little planning in your 30s and 40s, and a lot of planning in your 50s, you can avoid all that.”

Yardley Wealth Management LLC

37 S. Main Street

Yardley, PA 19067

(267) 573-1019

Photography by Jody Robinson

Published (and copyrighted) in Suburban Life magazine, November 2021.