BIRE’s Market

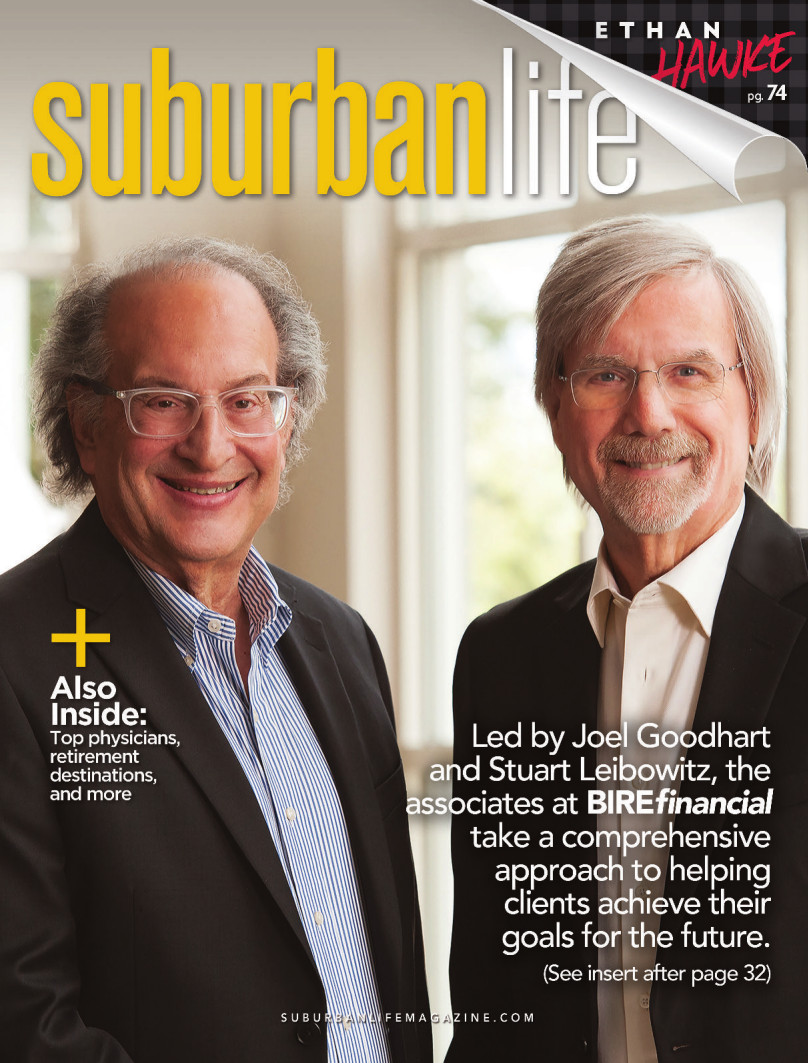

Led by Joel Goodhart and Stuart Leibowitz, the associates at BIREfinancial take a comprehensive approach to helping clients achieve their goals for the future.

For investors, prospective retirees, and business owners, the last 15 years have been an interesting ride. In the aftermath of the Great Recession and the COVID-19 pandemic, the economy has gone through different stages of recovery, the markets have rebounded, and the U.S. government has enacted several changes in the areas of taxes and health care, among others.

In an ever-changing landscape such as this, individuals and businesses may find it difficult to navigate alone. Fortunately, the team at BIREfinancial can help individuals and business owners achieve their financial goals, both in the short term and over the long haul.

“Your company’s name should represent what you do,” says Joel Goodhart, one of the founding partners of BIRE, which is comprised of five separate divisions: BIREfinancial, an independent financial-services firm that provides individual and corporate clients with comprehensive support in achieving their financial goals; BIREbenefits, which helps employers meet present and future needs as it relates to employee benefits and individuals with their Medicare supplement; BIREtirement, which assists corporate clients in establishing and maintaining their company 401(k), 403(b), 457 and Cash Balance plans; BIREmanagementofwealth, which enables each individual client to meet with a BIRE money manager “eyeball to eyeball” in creating asset allocation, portfolio strategies, and hands-on money management consistent with their risk tolerance and goals; and BIREpip (Partners In Planning), which identifies financial and legal issues that need to be addressed by professionals in allied disciplines.

Sleep Well At Night

BIRE is an acronym standing for the services it offers—Business, Individual, Retirement, and Estate—while its logo, a white swan, stands for the phrase “Sleep Well At Night” (SWAN). The firm’s seasoned advisor team manages more than $800 million in assets for its individual and business clients, on top of managing the benefits programs of 75 small and medium-sized companies.

BIRE is an acronym standing for the services it offers—Business, Individual, Retirement, and Estate—while its logo, a white swan, stands for the phrase “Sleep Well At Night” (SWAN). The firm’s seasoned advisor team manages more than $800 million in assets for its individual and business clients, on top of managing the benefits programs of 75 small and medium-sized companies.

Formed in 2004, BIRE is led by Goodhart and fellow founding partner Stuart Leibowitz, both Temple University alumni who have brought diverse life experiences and skills to the firm to help clients achieve their financial goals. In addition, both partners are members of the “Million Dollar Round Table,” which is an association of financial professionals based on sales.

Besides the two partners, BIRE is comprised of three other associates (Dennis Freedman, Edward Hogan, and Robert Logan), as well as 13 support staff. All five maintain the AIF (Accredited Investment Fiduciary) designation, meaning the advisors act under what is known as the fiduciary standard that requires them to act in the best interests of their clients.

Goodhart has been in the financial services industry since 1976, when a mentor suggested he consider a career in insurance. Leibowitz, meanwhile, practiced law for 25 years and had his own firm in Norristown before deciding to follow his true passion. The partners are 69 and 72, respectively, and therefore understand the needs of clients who are either preparing to retire or have retired and need help transitioning from decades of accumulation to what Goodhart calls “de-cumulation.”

“We have clients who come in and have done all the right things,” says Goodhart, who is a 16-year member of “Top of the Table,” based on sales and is recognized as a member of Ed Slott’s Master Elite IRA Advisor Group. “But they don’t know what to do now. … They were very proficient at accumulation, they signed up for their employer’s 401(k) and had money go in each month. Now that they have retired, though, they need that process to reverse to provide them with an income strategy.

“We manage money in buckets of five years,” he continues. “Our philosophy is that the money you need in next five years should be in cash; the money you need 20 years from now shouldn’t be in the bank making no money; and the money you leave your kids is 30-year money. A lot of what we do goes back to Stephen Covey [author of The 7 Habits of Highly Effective People], meaning begin with the end in mind and ask the question, ‘What is your big picture?’ I asked that question to one couple who said, ‘We have three kids and grandkids. We don’t want to make them rich, but we want to help if we can.’ I told them I can make both happen, because knowing your goal lets me place your assets where they should be.”

With BIREbenefits, led by Freedman, the firm focuses on designing and implementing cost-effective benefits plans for employers and Medicare supplement coverage for individuals. This can be especially challenging when one considers the flux of recent years, particularly surrounding the emergence of the Affordable Care Act and subsequent changes to it.

“Today’s business owner is looking for someone to be an advisor regarding the financial aspects of what they can do for their employees,” Freedman says. “It might appear that all employers have the same needs but they don’t, so we have to be creative. Every day we face challenges from the government and others to achieve that which helps our clients. Basically, we utilize our knowledge to help them navigate the healthcare maze.”

With BIREpip, which Leibowitz leads, the firm enlists the experience of a network of third-party professionals. These include attorneys, CPAs, property/casualty firms, mortgage companies, banks and others, all with the goal of helping clients make the most informed decisions regarding their financial future.

“In that sense we are truly a comprehensive, one-stop shop,” says Leibowitz, who maintains his license to practice law. “In the law, someone is always on the other side trying to take away one’s benefits, not pay a debt or accuse them of fault. I just want to help people. I want to use my experience to help them find the right strategies and solutions.

“We are a boutique firm, and we just keep growing,” he continues. “I think what sets us apart is our independence and the fact that we listen to the client with all the knowledge and experience we have behind us. We can then strategize and come up with solutions to let them make decisions with our guidance.”

Regardless of each client’s specific situation, BIRE’s goal remains to help each client reach their goals with the same life-changing realization. As Goodhart says, “You can’t change the past, but you can alter the future.”

BIRE’s Five D’s

The U.S. Department of Labor new “fiduciary rule,” which requires financial-services organizations to adhere to a best interest standard when advising investors on a retirement plan, took effect in 2021. The rule requires broker-dealers and investment advisers, as well as others who advise investors, to act in their clients’ best interests when providing retirement advice in exchange for a fee or other compensation.

The U.S. Department of Labor new “fiduciary rule,” which requires financial-services organizations to adhere to a best interest standard when advising investors on a retirement plan, took effect in 2021. The rule requires broker-dealers and investment advisers, as well as others who advise investors, to act in their clients’ best interests when providing retirement advice in exchange for a fee or other compensation.

Give BIREfinancial credit for staying ahead of the curve. Two years ago, the firm instituted the “Five D’s” to lead prospects through “a slow, transparent, step-by-step process” rooted in a deep understanding of an individual’s specific situation, risk profile, and goals for the future.

“The first D is Due Diligence,” he says. “The purpose of this appointment is to help the client prospect and their adviser get comfortable with each other. This is where we try to answer the question: ‘Do we want to work with them, and do they want to work with us?’”

The second D is Discovery, a step that begins when the firm sends the prospective client an email asking them to come back in for a second meeting, along with all pertinent financial information: bank statements, tax returns, investment statements, etc.

“The third D is Deliverable, where we deliver back to them our recommendations based on all of the information they shared,” Goodhart adds. “During that appointment, the adviser generally brings in a second chair so the client can meet with one of our money managers eyeball to eyeball.”

By the end of that third meeting, which could take as much as three hours, the prospective client has not paid a single dime for the firm’s time and expertise. Assuming the prospective client wishes to move forward—95 percent of them do, according to Goodhart—they proceed to the fourth D, Documents, when the client comes in to complete the necessary paperwork so BIREfinancial can start the investment process in earnest.

Which brings us to the fifth D, Delivery, where the firm establishes the “rules of engagement.” In the first year of the relationship, for example, BIRE meets with clients once a quarter, and after that the client decides how often they meet—once a year or, in some cases, as often as every other week. The purpose of these face-to-face meetings is “not to go over the numbers,” but to help the client and adviser know each other more closely. The same concept applies to another rule of engagement: meeting each investor’s heirs.

“A lot of our clients’ children or heirs live across the country, so we don’t necessarily have to meet the heirs face to face,” Goodhart says, suggesting remote platforms such as Zoom or Skype certainly come into play. “By getting to know the heirs up front, the client has the confidence to know their legacy will be passed on, and the heirs get to know us early into the relationship, not when we’re standing in line at a wake.”

BIREfinancial

4066 Butler Pike

Plymouth Meeting, PA 19462

(610) 825-4066 | bireswan.com

4066 Butler Pike

Plymouth Meeting, PA 19462

(610) 825-4066 | bireswan.com

Registered representatives offer securities through Parkland Securities, LLC.

Member FINRA/SIPC

BIREfinancial is independent of Parkland Securities, LLC

Member FINRA/SIPC

BIREfinancial is independent of Parkland Securities, LLC

Photo courtesy of BIRE

Published (and copyrighted) in Suburban Life magazine, August 2022.